Employers must file monthly PAYE returns and make tax payment by the 15th of the subsequent month.

Failure to file and pay Tax by the due date attracts a penalty of GHC 500 and a further penalty of GHC10 for each day that the tax is overdue.

Procedure to file PAYE Returns

- Visit the website on taxpayersportal.com

- Login with your TIN or Ghana Card and your password.

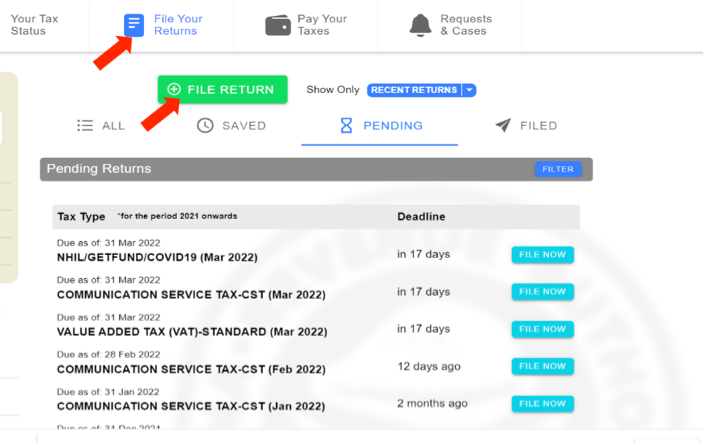

- Click on “File your Returns” and “File Return”

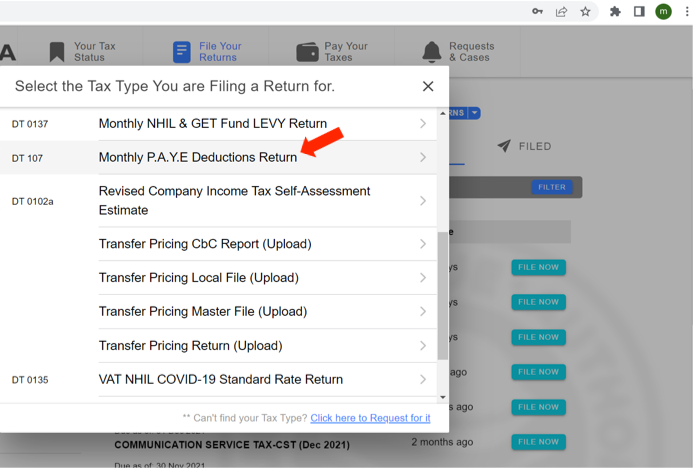

- Select the Monthly PAYE Deductions Return

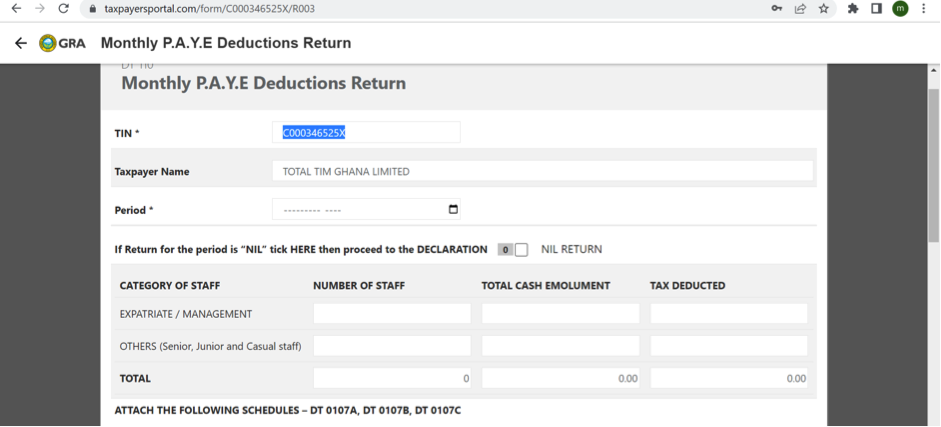

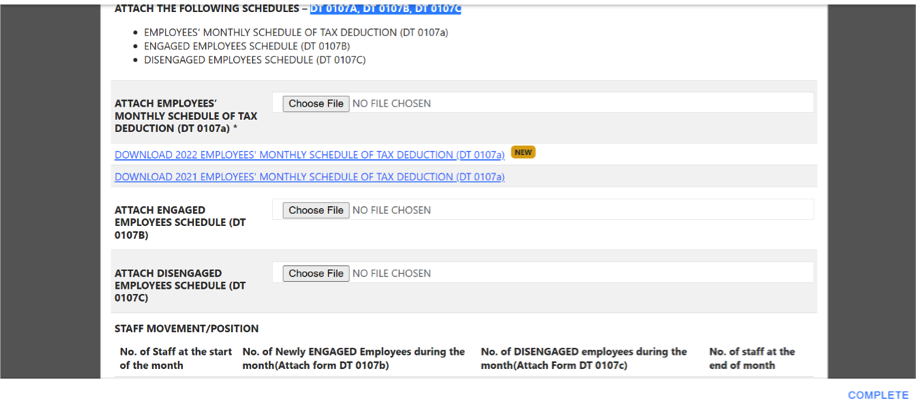

- Complete the form, download the PAYE schedules DT 0107A, DT 0107B, DT 0107C onto your computer, and fill it with the employee’s salary details. Attach the completed forms and select “Complete” to submit it.

- Once filing is complete, the next steps are to generate a tax bill and invoice for payment.

For more information and videos please follow SCG Chartered Accountants on Facebook, Twitter, Youtube and LinkedIn.