This blog answers common questions that people ask about tax audits.

1. What is a tax audit?

A tax audit is an examination of a taxpayer’s financial records and tax returns by the GRA to ensure that the taxpayer has accurately reported their income, deductions, and credits and complied with tax laws and regulations.

2. Why is my company chosen for a tax audit?

A tax audit can be triggered by taxpayer related red flags or GRA’s policies.

Some taxpayer related red flags are:

- Late or non-filing of tax returns, regular payment of penalties and interest.

- Consistently reporting of losses for over 3 years.

- Applying for a tax refund—GRA will conduct an audit to confirm the validity of the claim.

- Notifying of winding up or suspension of business operations.

- Unusual Income: If your reported income is significantly higher or lower than what is typical for your profession or industry, it may raise a red flag for the GRA.

- Past Audits: If they audited you in the past and there were issues with your returns, the GRA is more likely to audit you again in the future.

- Information mismatch – if the information on your tax return does not match the information provided by third parties, such as your employer or financial institutions, it may trigger an audit.

GRA policy considerations

- Random Selection – The GRA may randomly select taxpayers for an audit as part of their enforcement strategy.

- GRA policy—GRA has a policy of auditing entities every 3 years.

- Industry-specific issues – industries with a history of noncompliance or tax evasion, or are emerging e.g., e-commerce.

3. I am informed of an audit, what should I do?

Inform your tax consultant immediately you receive a notification of a tax audit, so you will jointly agree venue, date, and time for the audit.

If you don’t have a tax consultant, confirm the scope and date of the audit with the tax auditor. Ensure you have sufficient time to prepare.

4. Can I ask for time to prepare for the tax audit?

Yes, you can ask for time to prepare if the notice is short or inconvenient.

5. How many years does the audit cover

A maximum of 6 years, but if the tax auditors find fraud, willful default, or serious omissions in your tax returns for any year, the audit may go beyond the 6 years.

6. What documents are required for the tax audit?

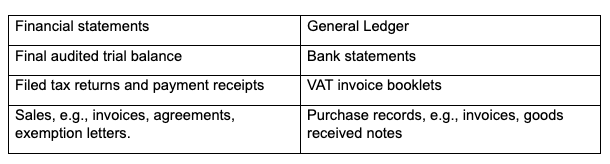

The crucial documents required for the audit are:

The auditor may request additional information and documents during the audit.

When you get a document request, check that you can produce them before the audit. Then assign your team to gather the documents and data.

7. What to do before you submit documents

- Check that you have all the documents requested.

- Review the documents and assess there are potential liabilities—penalties for late filings, possibilities of undeclared revenue, or overstatement of expenses for the period.

- If your review discloses gaps in your taxes, consider options for mitigating the gap.

- Submit the requested information after the introductory meeting.

8. What is the purpose of an introductory meeting with the GRA?

The introductory meeting enables you to:

- Provide GRA with key information, such as business background, operating model, and other relevant information about the management of the company.

- Understand the auditor’s approach to the audit and when they will finish the fieldwork.

- Get the contacts of the auditors.

- Get to know the auditors and get their contact details.

9. How long does the tax audit take?

Different issues affect how long a tax audit takes – the competence and approach of the tax auditors, how long it takes the auditee to provide information and respond to queries.

How long they take is not predictable, but it often takes longer than you would want. When GRA is auditing you, your concern should be to expedite the audit and avoid paying unnecessary taxes. Therefore, must plan for the tax audit.

10. Should I engage a tax consultant?

You can handle the audit without the help of a tax consultant. If your knowledge of the tax laws is not deep, you risk ending up with an assessment that you do not expect.

We strongly recommend that you engage or involve a tax consult from the inception of the audit. The tax consultant has the depth of tax knowledge and the experience of dealing with a tax audit. He could save you a lot of money and hassle.