Before you close your financial books for the year, you must make sure that you filed all returns and paid all taxes due during the year. This could save you significant penalties.

We’ve prepared this checklist to help you check your compliance and reduce the risk of incurring undue penalties.

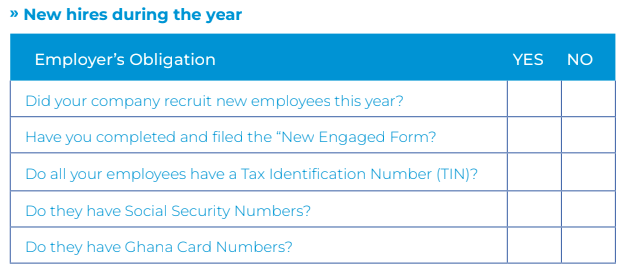

Do you have employees who do not have TIN or Social Security numbers? How did you handle payments to them? Note that you may have exposure to taxes, pension contributions, and penalties. Ensure you take steps to resolve

this before you close your books.

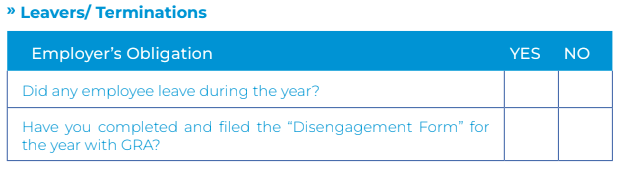

If you have not filed the disengagement form, do so before you close the books.

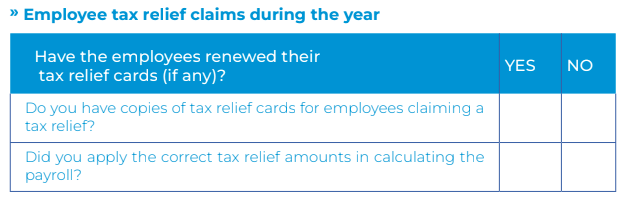

These reliefs granted by GRA are renewable every year, hence, employees can only access these reliefs if they have filed or `renewed the relief cards.

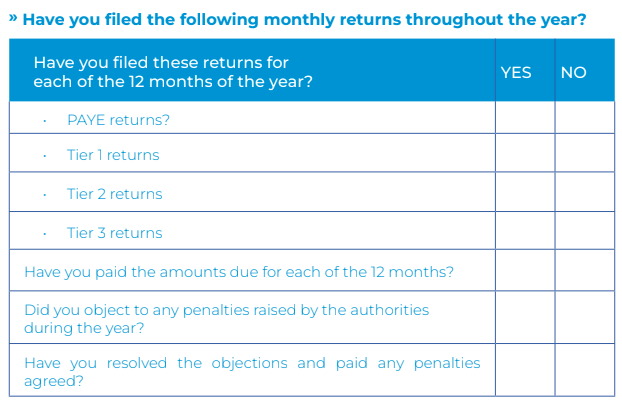

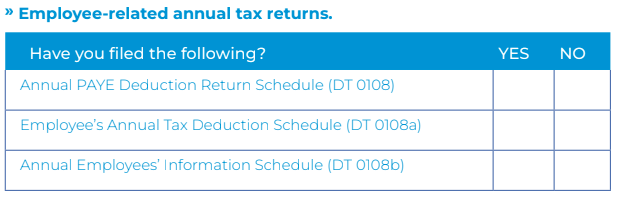

If you answered “No” to any of the above, ensure you file the return and make payments as soon as possible to avoid any penalties.

The deadline for filing these returns is 31st April.