The Ghana Revenue Authority (GRA) taxpayer portal is a work in progress. GRA often adds or changes features of the portal without adequate education and information. You often get to know of the changes when using the portal.

At SCG, we are heavy users of the taxpayer portal, so we learn from our experiences. To resolve our own taxes, we had to reconcile the withholding tax credits per the portal with our records.

In this article, we share how we reconciled the withholding tax credits and the challenges we faced.

Why reconcile your tax portal

The GRA tax portal is the primary sources that GRA uses to determine your tax liability and tax credits. If the data is incomplete or inaccurate, it can delay you completing your taxes or getting a tax clearance certificate. Here are the reasons you must reconcile your GRA taxpayer portal regularly.

1. Withholding taxes paid to GRA for you

The GRA allows you to offset only withholding taxes paid on your behalf against your tax liabilities. Reconciling your taxpayer portal will let you know how much of the withheld taxes your customers have paid and how much is unpaid.

You can then chase the customers who have not paid to pay the taxes they withheld to GRA.

2. Detect errors

Reconciling your taxpayer portal enables you to detect errors in filing and payments. The errors could be caused by GRA or the customer. You can then investigate the reasons for the error and have them corrected in time.

3. Certainty of tax credits to offset taxes

Reconciling your taxpayer portal helps you know precisely how much tax credits you have for offset against tax liabilities. You can then plan any cash requirements for taxes.

Steps to reconcile tax credits on the GRA taxpayer portal.

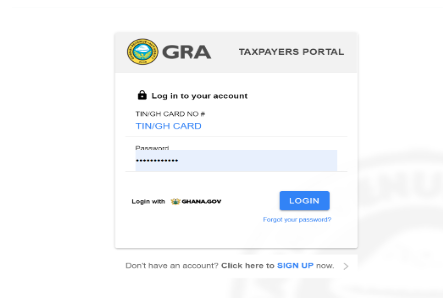

1. Log into your company’s taxpayer portal using your login details – TIN/GH Card and Password.

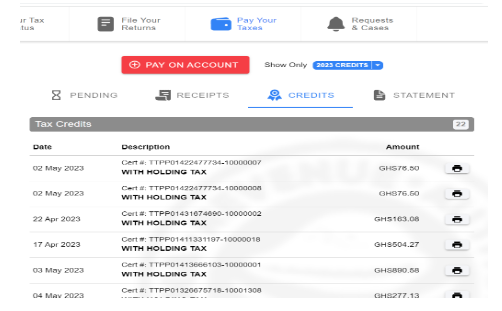

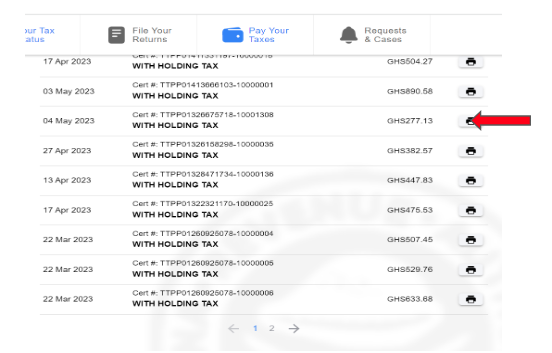

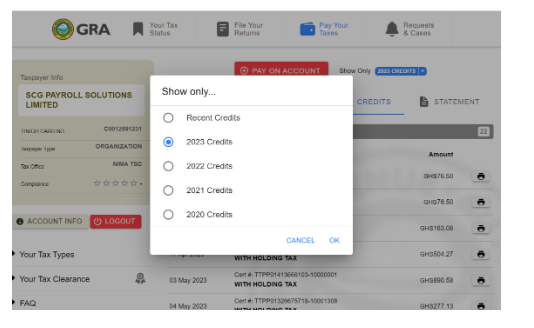

2. On the ‘Pay your taxes’ tab, click on ‘Credits’

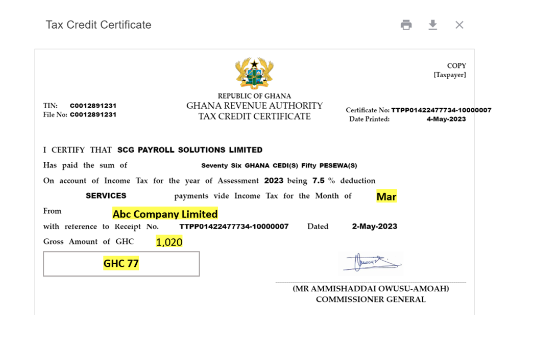

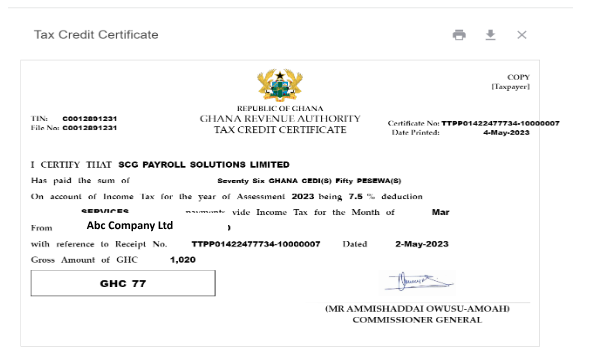

3. Select a withholding tax certificate from the dropdown list by clicking on the print symbol. This will show up a single tax credit filed by your client on your behalf, as indicated below.

***Sample TCC from GRA Portal

You can download the sample online TCC and reconcile with your records.

GRA allocates the TCCs to the years and month in which you file them. See the diagram below.

Reconciliation process in SCG

You must maintain a detailed list of taxes withheld by your clients. This is a precondition for effective reconciliation. At SCG, we maintain an account for outstanding withholding taxes and a supporting list of taxes withheld by our clients.

Download the online Withholding Tax Certificates (WTC) and reconcile it with the outstanding withholding tax (WHT) amount on the related invoice by following the steps below:

- Retrieve the invoice to which the TCC relates.

- Check the gross amount and month in which we received the payment on the invoice.

- Match the withholding tax amount outstanding on the invoice to the amount on the online TCC.

- Strike out the withholding tax from the list of outstanding withholding taxes.

Challenges

- The GRA offices do not automatically process WTH credits on a month-on-month basis. There could be a problem with the withholding taxes file by your client in a particular period, and this can delay the tax office from crediting your company’s portal.

- There could also be some inconsistencies with the amount a client filed for a particular month. For example, a client might have paid on two or three invoices in the same month and would have filed the amount together on the schedule, this could make it difficult to reconcile.

- An invoice in a foreign currency with the withholding tax amount filed in Ghana cedis could make reconciliation difficult, as there could be exchange rate differences. Here, the best thing you can do is to contact the client who filed the WHT and ask for a copy of the WHT schedule and the invoice numbers to which the payment relates. This helps to reconcile the right TCC to the client invoices.

- We realise that not all the GRA tax offices allocate the credit to our GRA portal. Some of the tax offices still issue manual TCCs. So, we still work with some hard copy certificates and the online credit certificates.

In our recent CIT filing, we filed the hard copy TCC together with the online TCC that we had reconciled in our books before arriving at a CIT payable to the year 2022. Our tax office accepted this.

Resolving the challenges

We recommend you reconcile your tax portal regularly so you can resolve any issues arising with the GRA Offices. As you can see, it can be a tedious process, and GRA can be slow to respond.

When reconciling the tax credits, look out for:

- name of the client

- amount withheld

- month in which the client filed the withholding tax, and

- gross amounts

as highlighted below.