We’re all about sharing our knowledge with you, serving as fuel to stem your business growth.

Our resources have been hand-crafted to help you create the solid foundations needed to take your business to the next level.

Tax Alert

In December 2023, the Ghanaian government enacted seven tax laws, six of which amend existing laws and one that introduces a new tax.

Tax Alert

In April 2023, the government of Ghana passed 3 amendments to the tax laws. Here are the key highlights of these amendments.

EMPLOYEE TAXES & PENSIONS YEAREND CHECKLIST

A year-end checklist to help you confirm compliance with Ghana employee tax and pensions requirement and reduce the risk of penalties.

Ghana Employment Contracts: An Aide-mémoire

This article is an aide memoire of the items to draft an employment contract to the requirements of the Ghana Labor Act.

It will be useful if you must draft an employment contract, but you do not know what to cover and you can’t afford an attorney to draft one for you.

CASE STUDY: SCG USES MINDBRIDGE TO IMPROVE CLIENT VALUE

At SCG, we use MindBridge AI, an artificial intelligence and machine learning audit platform that enables auditors to implement data analytics on their audits.

MindBridge published a case study on our use of the software in May 2022.

Key Ghana Tax Filing Dates You Must Know

Don’t miss a tax filing because you are not aware, or you forgot! Failing to file taxes on due date can result in penalties and interest.

Download this tax filing date guide. It lists the due date for the different taxes in Ghana

Ghana Effective tax rates for 2021

To help your business stay compliant, we have put together the approved tax rates applicable for 2021 tax year for easy reference.

Should you require more guidance, send us an email, or call and speak to our friendly tax team.

Keep up-to-date with your Tax Requirements

We understand that the word ‘tax’ can bring about stress and anxiety, so we’ve put together a list of resources to help you understand the concept better. We’ll help you to be compliant and to be aware of all the important tax dates and tax changes. Should you need more guidance at any time, send us an email or call us to chat to our friendly team.

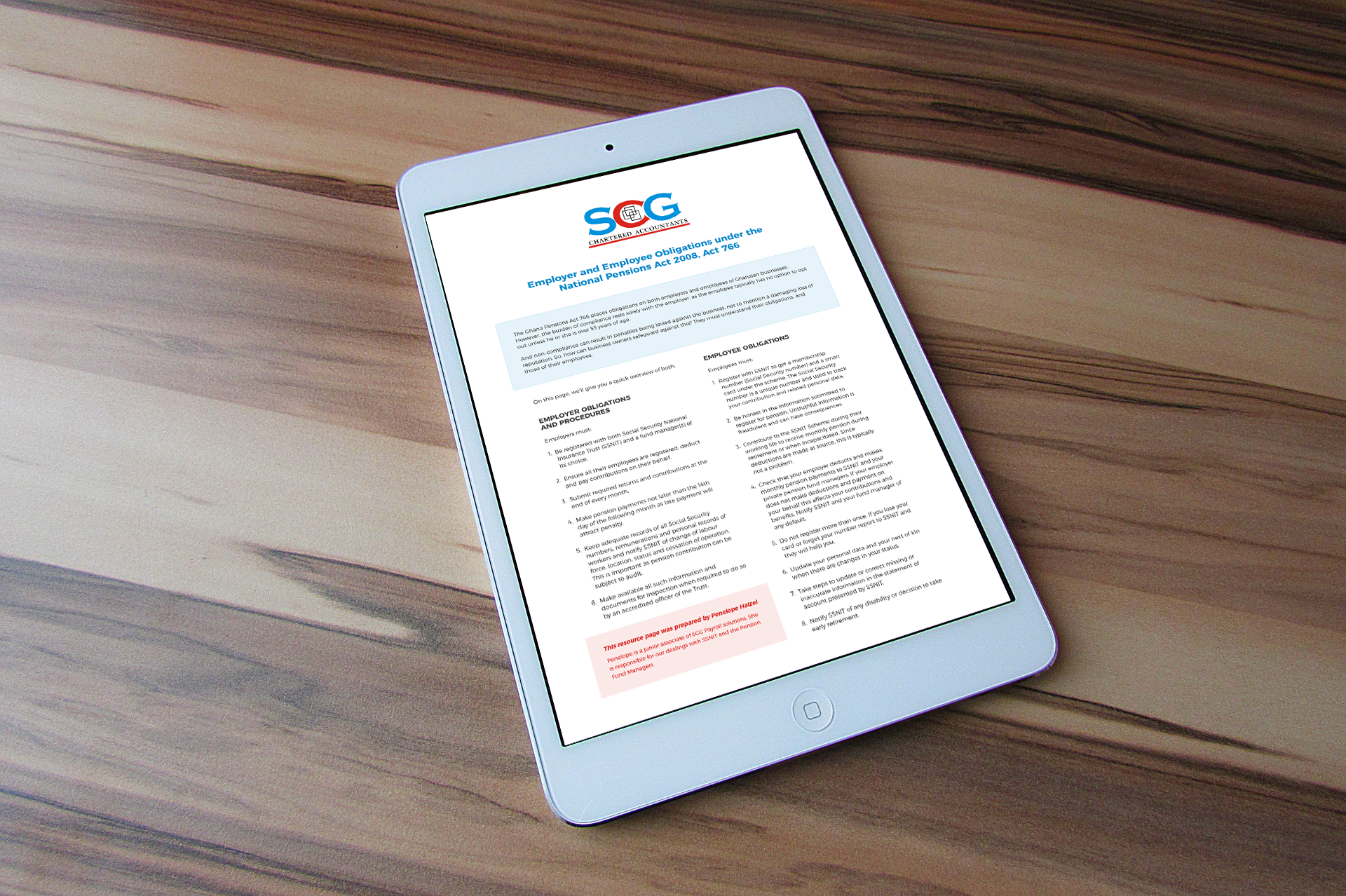

Learn about Employer and Employee Obligations under the National Pensions Act 2008, Act 766

The Ghana Pensions Act 766 places obligations on both employers and employees of Ghanaian businesses. However, the burden of compliance rests solely with the employer, as the employee typically has no option to opt out unless he or she is over 55 years of age.

Ethics and the future of the Accounting Profession in Ghana

Accounting is important for the development of any society. We cannot build significant businesses, or manage a country without high quality accounting, auditing and financial management. For that, you need a competent and vibrant profession, that operates to high ethical and professional standards.