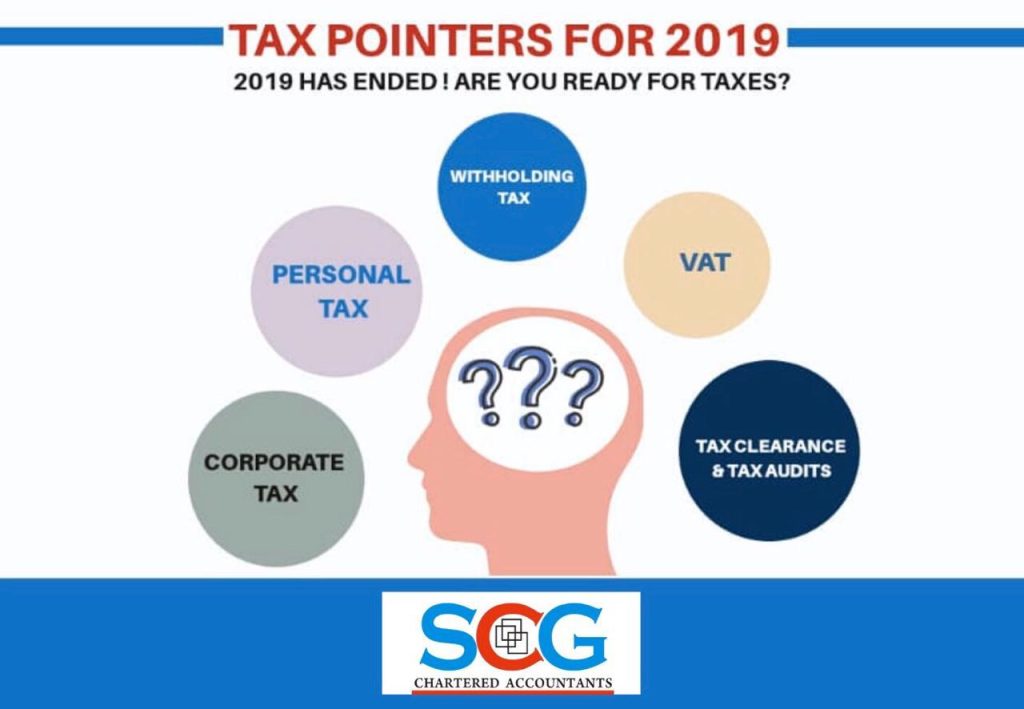

Early preparation is the best way to avoid tax trouble and reduce your taxes. This blog discusses the issues you must address as 2019 ends. So, what must you consider? Here’s a snapshot of the issues to ponder: Obtain Taxpayer Identification Number (TIN) for all your employees Withhold the appropriate taxes from all payments made […]

Category Archives: Tax

Discard tax documents before the retention period ends and you could be in trouble with the GRA. But you must confront your paper mountain that is taking up much-needed space. Before you do that, read on. What are tax documents? A tax document provides information to help the GRA to assess your tax. Examples of […]

Under Ghana tax laws, you must file a personal income tax return for each year of assessment. A year of assessment is the tax year in which you make the income. Read on to understand what a personal income tax return is, and what goes in, so you file personal income tax returns that are […]

Are you a foreign national working in a country other than your home country? Or, you are a Ghanaian national, but you earn income outside Ghana. Who will tax your income? It depends on your tax residence. Your tax residence settles which countries can tax you. BASIS OF TAXATION If you are resident in Ghana […]

Doing business with GRA is a pain! Remember your frustrations with GRA? What about documents that get lost over and over? Or tax files that are incomplete or lost! How about enquiries that nobody at GRA bothers to respond to? GRA just made a big promise that this era is over! It is digitizing tax […]

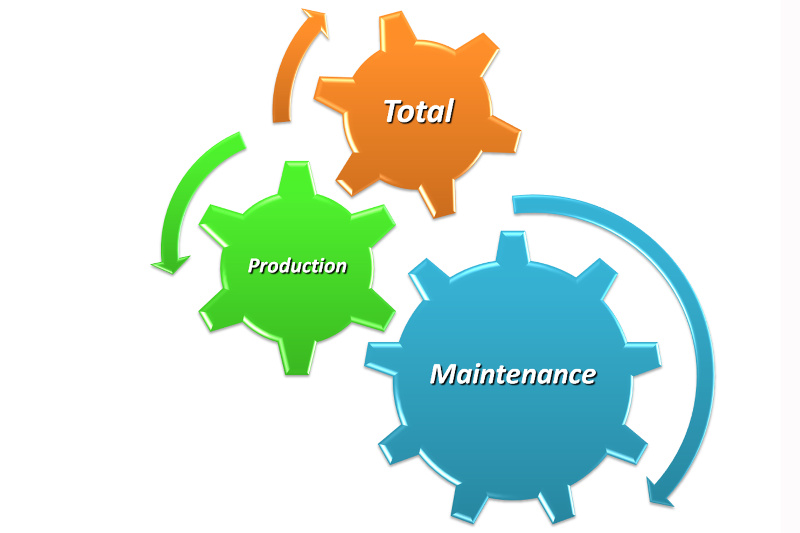

In this post, we’re going to discuss the basics of Value Added Tax (VAT). By the end, you should understand the different types of supply, and how that affects the tax charged. What is VAT? VAT is a tax applied on the value added to goods and services at each stage in the production and […]

You need a tax clearance certificate (TCC) for certain transactions. And sometimes, you need it in a hurry! We described some transactions you will need a tax clearance for, and the process for getting a tax clearance in our blog, “How to obtain a tax clearance certificate without any hassle.” I process a lot of […]

The year has ended, and another has just begun. Where does the time go? If you’ve not already made plans to ensure you’re compliant with your employee tax obligations, it’s not too late to start. To be compliant, here’s what you need to do: 1. File Your Returns Have you filed the following returns throughout […]

Early preparation is the best way to avoid tax trouble and reduce your taxes. This blog discusses the issues you must consider and address as 2018 ends. So, what must you consider? Please read on to find out. 1. Filing of Returns Have you filed the following tax returns? Monthly withholding tax returns. Monthly VAT returns. […]

How Ghana tax laws undermine capital creation and private sector growth: The case of maintenance expenses. On January 1st, 2016 Act 896 of the Income Tax Act 2015 came into effect, superseding Act 592 of the Internal Revenue Act 2000. Act 896 made significant changes to the rules for deducting repairs and maintenance expenses. In […]